Latest scams, fraud and phishing activity - NAB

How to report suspicious messages

Forward (then delete) suspicious emails to phish@nab.com.au and text messages to 0476 220 003 (047 NAB 0003).

If your online security has been compromised, or if you’re concerned about a transaction let us know immediately. Call us 24 hours, 7 days a week – Option 3, then select the most appropriate option for your situation.

- Within Australia: 13 22 65

- Overseas: +61 3 8641 9083

How to spot a scam

Think before you respond. Is NAB really contacting you?

- We’ll never send you an email or text asking you to provide personal information.

- We’re stopping the use of links in unexpected texts.

- If you get an unexpected text message claiming to be from us, don’t click on the link.

- We’ll never ask you to download programs directly from our site. We’ll always direct you to the appropriate download source.

- When sending phishing emails, criminals sometimes set the sender’s name as “NAB”. This doesn’t mean our systems have been breached, it simply means a criminal is impersonating our brand.

Forward (then delete) suspicious emails to phish@nab.com.au and text messages to 0476 220 003 (047 NAB 0003).

Latest scam alerts

Investment scams impersonating high profile experts – January 2026

Australians are currently being targeted by criminals impersonating high-profile people, such as nabtrade markets expert Tom Piotrowski. These scams may appear as fake ads, videos, pictures on social media platforms or via WhatsApp. They may also appear as unexpected contact via social media, email or SMS.

Pay attention to these red flags:

- Contact may be unexpected or via what appears to be an official advertisement. Criminals often reach out on social media or SMS. These scams may copy the branding of NAB or nabtrade. Stop and take time before you act, especially if you are being pressured.

- The investment opportunity may offer better than average returns or appear too good to be true. Criminals often use urgency, such as a stock that will soon grow in value, to convince people to invest. Check with the company directly using official, publicly listed details.

- Customers may be instructed to make a transfer to another financial account, or to a cryptocurrency wallet.

What can you do to protect yourself?

- Never interact with offers or communications that are “out of the blue” or unexpected, NAB or NAB affiliates will never contact you outside of authenticated and decided upon channels unexpectedly.

- If an offer is too good to be true it is very likely to be a scam. Investment opportunities that you cannot find other references to online or on the official NAB website are not lucrative, they are investment scams.

- If an offer carries a sense of urgency, it is likely a scam, NAB would not provide time sensitive advice that requires immediate action, such as stock options to be purchased before they rise in price.

If you have received this type of social media content, email or text message, please report it via email to: phish@nab.com.au or forward the text to: 0476 220 003.

If you have received this type of social media content, email or text message and have transferred money or provided information, contact us immediately on 13 22 65 or visit your nearest NAB branch immediately. .

NAB-branded scam emails and text messages – January 2026

NAB is aware Australians are receiving scam text messages and emails purporting to be from legitimate businesses including “NAB”, saying you have “Rewards Points”, you need to redeem via a scam URL before they expire.

Do not click the link or provide any information.

- The text messages and emails will say that you have earned “Reward Points” and you must redeem them before they expire soon. They will provide a link in the message for you to click on or copy into your browser. Do no click or copy this link as it will take you to a fake NAB or other branded website that will attempt to capture your bank details, such as your internet banking login credentials or card details, including your card pin. NAB will never ask you for your card pin.

- Do not reply to the message, click the link or copy the URL into your browser, block the sender immediately.

- If you’re unsure whether a message is legitimate, do not provide any information or transfer money. Contact us directly on the number on the back of your NAB card. NAB will never send unexpected text messages with links in them.

If you have received this type of email or text message, please report it via email to: phish@nab.com.au

If you have received this type of email or text message and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

NAB-branded emails targeting NAB customers – December 2025

NAB is aware of phishing emails attempting to impersonate ‘NAB Support’ with a Customer Service Team sign-off. The email may say there’s been a recent direct debit scheduled that has been applied to your account.

Do not call the number, click the link, agree to transfer money, or provide information.

The email indicates a direct debit request is scheduled to be processed.

The email directs to call a number if the transaction is incorrect.

If you are unsure whether an email is legitimate, do not provide any information, do not click on any links or transfer money. Contact NAB directly on the number on the back of your NAB card.

If you have received this email, please report it to phish@nab.com.au

If you have received this email and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Remote access scams targeting NAB customers – November 2025

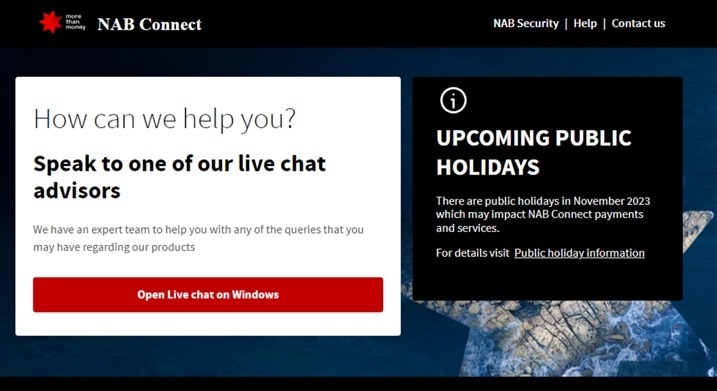

NAB is aware of criminals hosting fake NAB Connect websites with a “live chat” feature that may install remote access software allowing criminals to control your device. Criminals may also direct you to call a number impersonating a NAB call centre.

- Criminals are hosting fake NAB Connect websites with fake live chat links which download remote access software.

- Criminals may call you pretending to work for NAB regarding a fraudulent transaction, saying they are attempting to restore access to your accounts. They’ll request remote access to your devices, which may involve downloading “special software”.

- Do not provide remote access to any unsolicited callers, as this may give criminals access to information on your device or access to your banking.

- If in doubt whether an issue is legitimate, call your banker on the number on NAB’s website.

- Learn more at nab.com.au/remoteaccessscams

If you believe that you have lost money to a business impersonation scam or investment scam, contact us on 13 22 65 or visit your nearest NAB branch immediately.

NAB-branded emails targeting customers – November 2025

NAB is aware of phishing emails attempting to impersonate “NAB Security Team”. The email may say they have noticed unusual activity on your NAB account, urging you to click a link or call a number if the payment does not look familiar.

Do not call the number, click the link, agree to transfer money, or provide information.

- The email indicates there has been unusual activity on your NAB account.

- The email directs you to call a number, or to contact “NAB Security” by clicking on a link.

- The email mentions details of a fake transaction you would not recognise.

- If you’re unsure whether an email is legitimate, don’t provide any information, click on any links or transfer money. Contact NAB directly on the number on the back of your NAB card.

If you have received this email, please report it to phish@nab.com.au, then proceed to delete the email.

If you have received this email and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Information stealer – November 2025

Australians, including NAB customers, may be impacted by information stealers (also known as info stealers), with cybercriminals secretly capturing data and information such as login credentials, browser data, saved credit card details, documents, and more. The stolen information can be used by cybercriminals to target your personal accounts, such as banking or superannuation accounts, and can lead to fraud or account takeover.

NAB monitors customer account details that have been exposed online, and, if we spot something suspicious, we take action to protect customers. We'll let customers know if suspicious activity is detected on their account.

How to better protect your devices and online account:

Using long, unique passwords for each of your online accounts, and changing them periodically. Read more here: Create good password management habits - NAB.

Turning on multi-factor authentication wherever possible to add an extra layer of security. Learn more here: The benefits of Multi-Factor Authentication - NAB.

Looking out for suspicious messages and not clicking on links and/or attachments.

Turning on automatic updates to protect your devices, and having up-to-date anti-virus software.

Keep an eye on your bank accounts for suspicious activity and contact your bank immediately if you’re concerned or notice unauthorised transactions.

Read more about malware here: Malware | easy ways to protect your computer - NAB and on the Federal Government’s Cyber website: Information stealer malware | Cyber.gov.au

NAB-branded emails targeting customers – October 2025

NAB is aware of phishing emails attempting to impersonate “NAB Business” or “NAB Personal”. The email may say there’s been “a few refinements” to the terms and conditions and ask you to “read & confirm to T&Cs” by clicking on a link.

Do not call the number, click the link, agree to transfer money, or provide information.

- The email indicates there have been “refinements” to the “Personal Transaction and Saving Accounts Terms and Conditions”.

- The email directs you to call a number to click a link to “Read and Confirm to T&C”

- If you’re unsure whether an email is legitimate, don’t provide any information, click on any links or transfer money. Contact NAB directly using number on the back of your NAB card.

If you have received this email, please report it to phish@nab.com.au.

If you have received this email and have transferred money or provided any information by clicking on the link, contact us on 13 22 65 or visit your nearest NAB branch immediately.

NAB-branded emails targeting customers – October 2025

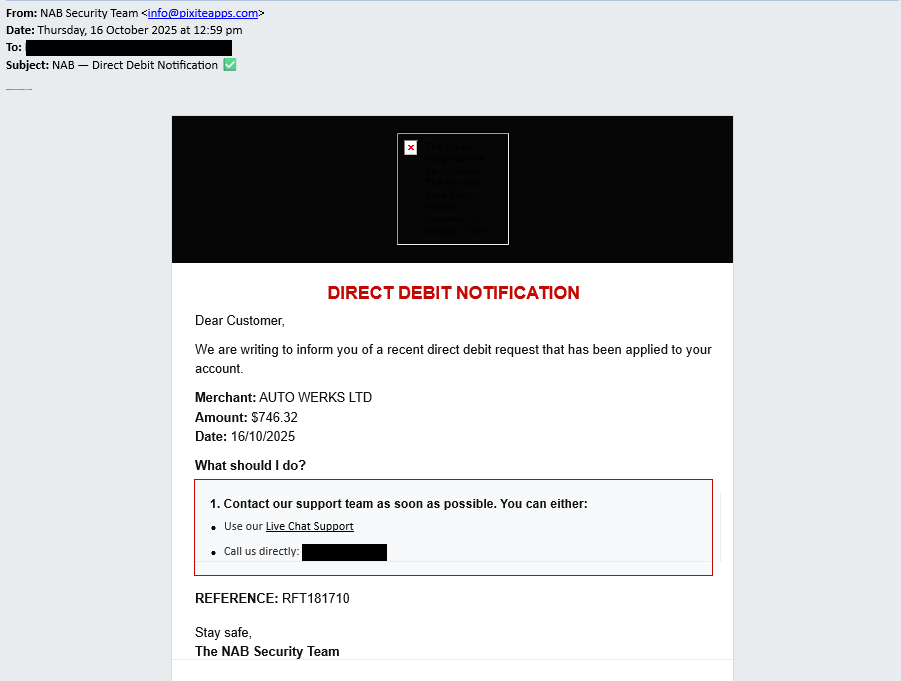

NAB is aware of phishing emails attempting to impersonate “NAB Security Team”. The email may say there’s been a recent direct debit request that has been applied to your account.

Do not call the number, click the link, agree to transfer money, or provide information.

- The email indicates a direct debit request has been made.

- The email directs you to call a number to “contact our support team as soon as possible” including reference number.

- The email instructs you to click on a link to use “Live Chat Support”

- If you’re unsure whether an email is legitimate, don’t provide any information, click on any links or transfer money. Contact NAB directly on the number on the back of your NAB card.

If you have received this email, please report it to phish@nab.com.au.

If you have received this email and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

NAB Branded scam text messages - October 2025

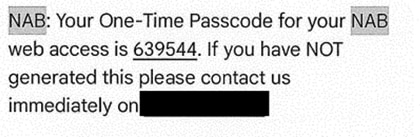

NAB is aware of text messages claiming to be from NAB with a "One-Time Passcode" and a number to call.

Do not engage or click any link; do not call the number or provide any information.

- The text message may provide you with a “One-Time Passcode for you to access your account”. The text message may ask you to call NAB on a phone number if you didn’t make a transaction.

- If unsure whether a call or text message is legitimate, don’t provide any information or transfer money. Contact NAB directly on the number on the back of your NAB card.

- NAB will not send unexpected text messages.

If you have received this type of text message, please report it to phish@nab.com.au.

If you have received this email and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

NAB-branded scam emails - Aug 2025

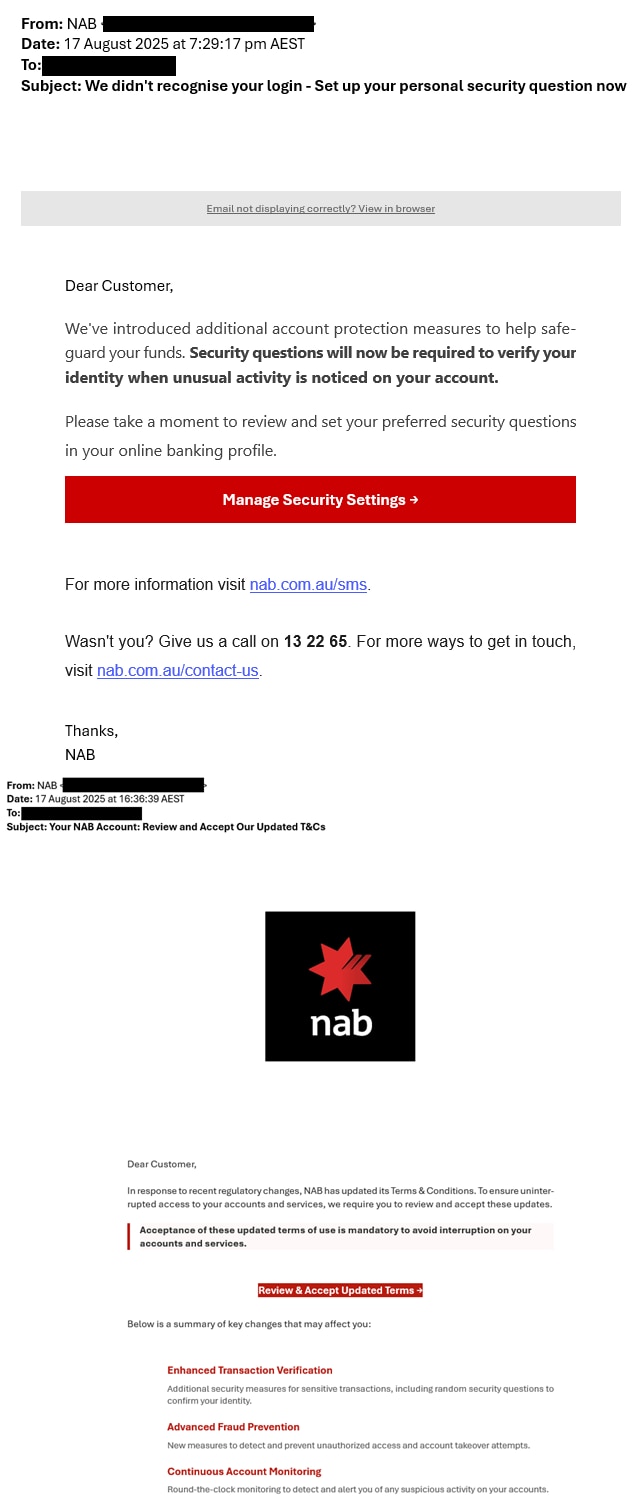

NAB is aware Australians are receiving emails claiming to be from “NAB” saying you need to “Review and Accept Our Updated T&Cs”, or that there’s been an unrecognised log in, and you need to update your “Security Questions”.

Do not click the link, transfer any money or provide any information.

- The email may mention that “NAB” has updated the terms of use of your account, or there’s a need to update your security questions and asks you to click a link to accept the terms and conditions or to update your security questions.

- This is not a real request from NAB.

- Do not respond or click on any links the email, as they will likely lead to a fake NAB site designed to steal customer information.

- You may be asked to transfer money to a “safe account”. NAB will never ask you to transfer money to another account to keep it safe – it’s safe where it is.

- If you’re unsure whether a request is legitimate, don’t provide any information or transfer money. Contact us directly on the number on the back of your NAB card. NAB will not send unexpected text messages with links in them.

If you have received this type of email, please report it to phish@nab.com.au.

If you have received this type of email and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

NAB-branded scam emails - July 2025

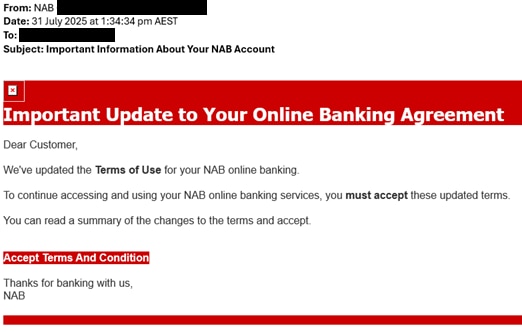

NAB is aware Australians are receiving emails claiming to be from “NAB” saying there is an “Important Update to Your Online Banking Agreement”.

Do not agree to transfer any money or provide any information.

- The email may mention that “NAB” has updated the terms of use of your account and asks you to click a button to accept said terms and conditions. This is not a real request from NAB.

- Do not respond or click on any links the email, as they will likely lead to a fake NAB site designed to steal customer information.

- You may be asked to transfer money to a “safe account”. NAB will never ask you to transfer money to another account to keep it safe – it’s safe where it is.

- If you’re unsure whether a request is legitimate, don’t provide any information or transfer money. Contact us directly on the number on the back of your NAB card. NAB will not send unexpected text messages with links in them.

If you have received this type of email, please report it to phish@nab.com.au.

If you have received this type of email and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Qantas cyber incident update - July 2025

NAB is aware of a cyber incident involving Qantas that has exposed some Qantas customer information including, names, email addresses, and phone numbers. If you have been impacted, please be on alert for an increased chance of being targeted by phishing messages.

What you can do

The exposed personal information can lead to higher risk of targeted phishing and social engineering campaigns, or attempted access to accounts.

- Be alert for unexpected phone calls, texts, or emails appearing to come from Qantas. Criminals regularly impersonate brands (called spoofing) and may have additional information from this incident to appear legitimate.

- Please report any phishing to the respective business they are impersonating

- If in doubt about the legitimacy of a contact, don’t action anything, and contact the organisation back through an official channel.

- You can keep updated on the Qantas incident via Information for customers on cyber incident

If you have received this type of email or text message and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

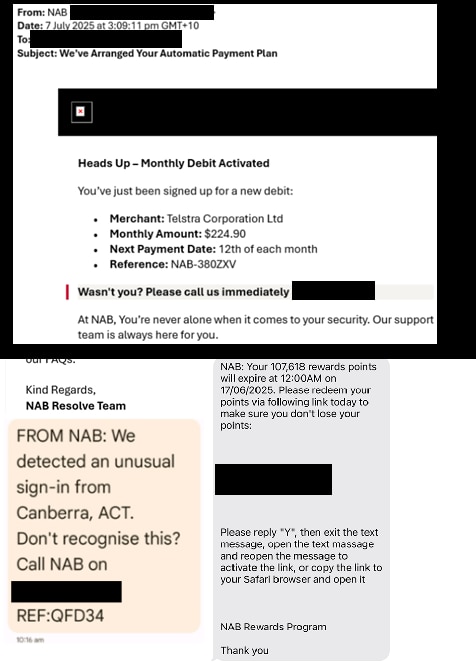

NAB-branded scam emails and text messages - June 2025

NAB is aware Australians are receiving scam text messages and emails claiming to be from senders such as “NAB”, “NAB’s Resolve Team” or “NAB Rewards” saying there’s an issue with their account, there is a new transaction or direct debit, or NAB Rewards points will be expiring.

Do not agree to transfer any money or provide any information.

- The email or text message may say there has been an unusual sign in or transaction, or that the phone number on your account has been updated. The message may ask you to call “NAB” on a phone number if you didn’t sign in or make this update or transaction. In another scenario, the message might say you have NAB Rewards points that are expiring soon, and ask you to reply to the message or click a link.

- Do not respond or click on any links in the SMS or email, as they will likely lead to a fake NAB site designed to steal customer information.

- You may be asked to transfer money to a “safe account”. NAB will never ask you to transfer money to another account to keep it safe – it’s safe where it is.

- If you’re unsure whether a call or text message is legitimate, don’t provide any information or transfer money. Contact us directly on the number on the back of your NAB card. NAB will not send unexpected text messages with links in them.

If you have received this type of email or text message, please report it to phish@nab.com.au.

If you have received this type of email or text message and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Update on compromised passwords in the media - July 2025

You may have seen reports in the media regarding published lists of compromised username and password combinations, including for sites such as Facebook, Google and Apple. NAB colleague or customer systems have not been compromised and remain secure.

Media sources are reporting that large databases have been found by security researchers which contain credentials collected across multiple online platforms. This does not appear to be a data breach of one platform in particular. Instead, it appears to be information collected from multiple sources, including malicious software.

Internet users, including some NAB customers, may have downloaded malicious software onto their computers or phones, which has collected information like their usernames and passwords for some websites, from their devices. This type of malware is known as an “infostealer”. Criminals may then post these details for sale on the dark web.

NAB monitors for customer account details that have been exposed online, and, if we spot something suspicious, we take action to protect customers. We'll let customers know if suspicious activity is detected on their account.

How do I know if there's malicious software on my device?

Signs you might have malware on your device can include devices running unusually slow, crashing or new unexpected applications or icons appearing. If you think there’s malicious software on your device, run an anti-virus scan or consult an IT professional for further advice.

You can help protect your devices and accounts by:

- Using unique and complex passwords for each of your online accounts and changing them periodically. Read more here: Create good password management habits - NAB

- Turning on multi-factor authentication wherever possible to add an extra layer of security. Learn more here: The benefits of Multi-Factor Authentication - NAB

- Only downloading apps from the genuine Apple App and Google Play Stores

- Looking out for suspicious messages and not clicking on links/attachments

- Turning on automatic updates to protect your devices and having up-to-date anti-virus software.

- Keep an eye on your bank accounts for suspicious activity and contact your bank immediately if you’re concerned or notice unauthorised transactions.

Read more about malware here: Malware | easy ways to protect your computer - NAB on the Federal Government’s Cyber website: How to protect yourself from malware | Cyber.gov.au.

Please report any suspicious messages or calls to phish@nab.com.au or to 047 622 0003 (047 NAB 0003.)

For more information and to see the latest security alerts, visit nab.com.au/securityalerts.

Reports of stolen shares – July 2025

ASIC has advised that Australians are currently being targeted by criminals impersonating individuals to steal their shares.

How are criminals stealing shares?

In an example, a criminal claiming to be ‘John Citizen’ creates a share trading account to sell shares owned by the real John Citizen.

The criminal uses stolen ID documents, as well as illegally obtained CHESS and Issuer Sponsored Holding Statements, to open the fraudulent account and then transfer the shares into that account. These documents could be stolen as the result of a third-party data breach or mail theft from letter boxes.

Tips to reduce the risk of share theft

Regularly review your share portfolio(s), so that you can act quickly if you see something wrong. Ensure your contact details are up to date with your stockbroker, share registry and financial service provider.

Lock and regularly check your letterbox to prevent mail theft.

Create strong, unique passwords for your online accounts.

Turn on multi-factor authentication for your online accounts, where possible.

For more information, please see ASIC’s Alert: Investor alert: Reports of stolen shares due to identity theft on the rise | ASIC, opens in new window

If you’re a nabtrade customer and believe that you have lost shares due to this issue, contact us on 13 13 80 (or if calling from overseas +61 3 8903 9991).

Card and PIN collection scams - April 2025

Australians are currently being targeted by criminals posing as a bank, IT company, payment service, Government agency or telecommunications provider. The caller may claim that your bank accounts or computer aren’t secure and your money isn’t safe, and ask you to provide your bank card and PIN.

How do they work?

- You may receive a phone call or see a pop-up message on your phone or computer stating there’s an issue with your device or account

- You’ll be asked to share your PIN, and told to leave your bank card in your letterbox so it can be “cancelled and replaced”

- You may be asked to withdraw cash and leave it in your letterbox, or they may state they need to pick the cash up from you directly

Do not share your card or PIN with unsolicited callers.

NAB will never ask you to:

- Disclose your PIN or full card details

- Leave your bank card out to be collected

- Withdraw cash from your account, so it can be “checked”

- Transfer money to another account to keep it secure

If you have received this type of contact, please report it to phish@nab.com.au

If you believe that you have been scammed, contact us on 13 22 65 or visit your nearest NAB branch, opens in new window immediately.

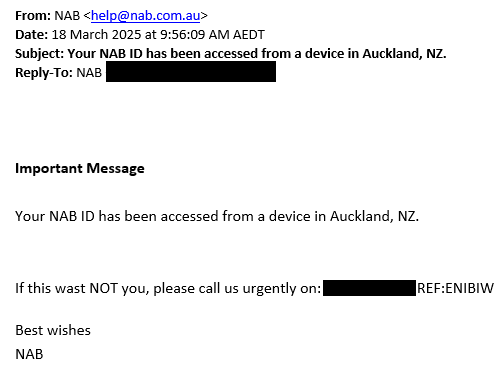

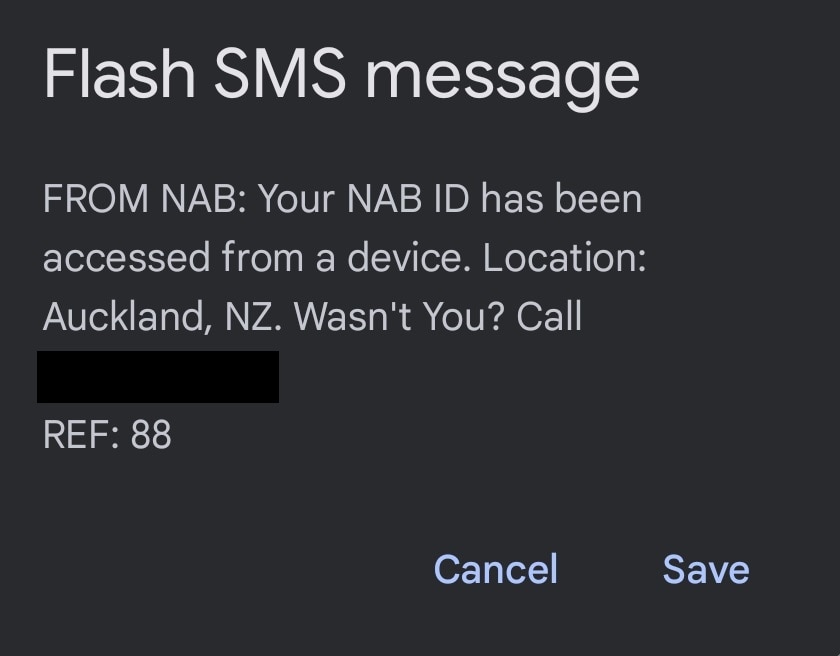

NAB-branded emails and flash SMS messages targeting customers – March 2025

NAB is aware of phishing emails and flash SMS messages attempting to impersonate “NAB” or “NAB’s Fraud team”. The email or message may state unusual activity has been detected on your account and to call a phone number to “ensure the safety of your account”.

A Flash SMS is a temporary text message that appears directly on a phone screen, even if locked. It disappears unless saved to your message inbox or screen grabbed.

NAB does not use flash pop-up messages to contact customers.

Do not call the number, agree to transfer any money, or provide any information.

If you’re unsure whether an email or message is legitimate, don’t provide any information or transfer money. Contact us directly on the number on the back of your NAB card.

If you have received this email or SMS message, please report it to phish@nab.com.au.

If you have received this message and have transferred money or provided information, contact us on 13 22 65 or visit your nearest NAB branch immediately.

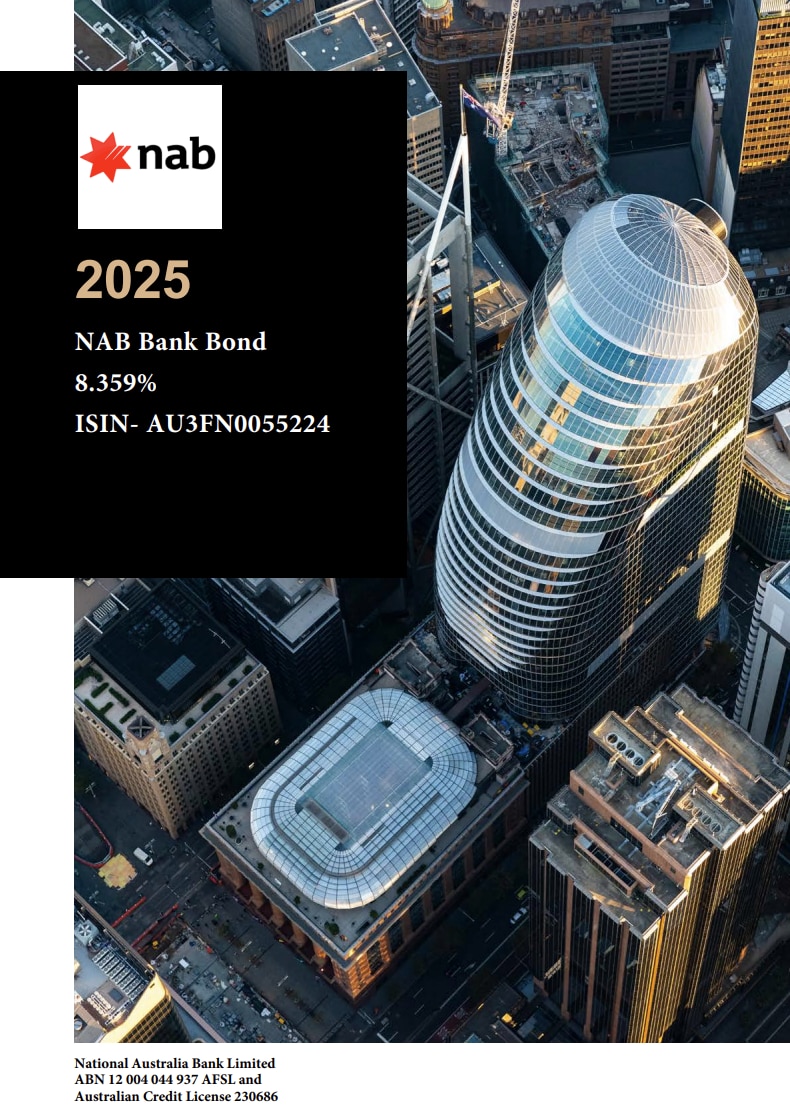

Bank impersonation investment scams - March 2025

Australians are currently being targeted by criminals posing as a bank or financial institution promising lucrative investment or term deposit returns.

- Criminals may contact people on social media or via email posing as a broker or advisor from a bank or financial institution.

- The criminal may send the customer a very convincing looking “prospectus” highlighting the “offer”. The “prospectus” may copy the branding of a legitimate financial institution or bank.

- The criminal may impersonate the names and signatures of legitimate people working at the financial institution or bank.

- The investment or term deposit offers better than average returns.

- The person may be instructed to make a transfer to another financial account, or to a cryptocurrency wallet.

If you believe that you have paid money in a bank impersonation scam or investment scam, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Fake gambling websites targeting Australians– February 2025

Australians are currently being targeted by fake online gambling sites.

Common red flags:

You might see an ad on social media or be referred by a friend to online gambling sites

You might be asked to pay for credits by transferring money through a PayID® (that changes regularly) or by paying on credit card on the site

You will usually lose the money you’ve deposited and be encouraged to deposit more, with bonus credits being offered

You may receive bonus credit or payments for joining, or referring family and friends to the site

The site is not well-known

The Australian Communications and Media Authority (ACMA) has more information about protecting yourself from illegal gambling websites, including a list of blocked sites and how to report illegal gambling sites: Protect yourself from illegal gambling operators.

If you need help with gambling, please visit Gambling Help Online.

If you believe that you have lost money to a gambling scam, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Customers getting security notification that their password has been compromised - January 2025

Summary

When trying to sign in to the NAB app or Internet Banking, customers may see a notification on their Apple smartphone that their password has been compromised in a data breach and needs to be changed.

Please be aware this notification is a new feature from Apple’s Passwords app, not from NAB.

You may see this if you’ve saved your NAB Internet Banking password in the Apple Passwords App (or Keychain). It is alerting you that your saved password has appeared on a list of exposed passwords; it does not mean your own NAB account has been compromised.

A screenshot of the message from Apple Passwords that might pop up when customers try to log in to the NAB app/Internet Banking is below. Please note, other password manager accounts also send these notifications.

Action required

While this notification doesn’t mean your own NAB account has been compromised, if you see this message, you should update your NAB Internet Banking password to a complex unique password (which is not used elsewhere). There is information available at nab.com.au/passwordsecurity on best practice passwords.

For more information, you can read this article about Apple’s compromised passwords notification feature.

Job Offer and Employment scams -December 2024

NAB is aware of employment scams targeting the community.

How do they work?

- Criminals can offer jobs that pay very well with low effort however, these jobs often don’t exist.

- Criminals pretend to be hiring on behalf of high-profile companies and online shopping platforms and impersonate well-known recruitment agencies.

- Their goal is to steal your money and your identity details. Criminals will often direct you to either pay money to receive a ‘guaranteed payment’, promote items online, or download suspicious applications to your device.

- Be suspicious if a role is offered to you without an interview or discussion about your experience, suitability and references.

- Stop and check any job offers that seem too lucrative to be true. Research the recruiter and the business or individual offering the position. Contact the recruitment agency via phone numbers sourced from an independent internet search.

- If you believe you have been involved in an employment scam, please reach out to ReportCyber.

If you believe you have lost money to an employment scam, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Remote access scams targeting NAB Business customers – November 2024

Australians are currently being targeted by criminals posing as a bank or other well-known organisations (including the NBN, a telecommunications provider or technology company) requesting remote access to your devices to remove “viruses” or “fix an issue”.

- Criminals may call you pretending to work for a bank or other business regarding a “virus” or “issue”. They’ll request remote access to your devices, which may involve downloading “special software”.

- Alternatively, you may receive an email stating you’ll receive a call soon regarding a similar issue.

- Do not provide remote access to any unsolicited callers, as this may give criminals access to information on your device or access to your banking.

- If in doubt whether an issue is legitimate, call your banker or the number on NAB’s website.

- Learn more at nab.com.au/remoteaccessscams

If you believe that you have lost money to a business impersonation scam or investment scam, contact us on 13 22 65 or visit your nearest NAB branch immediately.

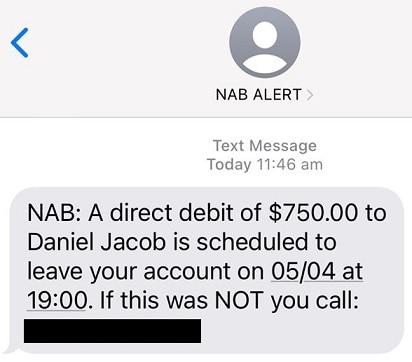

NAB branded SMS phishing requesting payment confirmation – March 2024

The SMS contains a number for a fake call centre asking you to verify a scheduled payment. Do not call the number or provide any information.

- The message claims to be from NAB stating you’ve scheduled a payment to a payee.

- It asks you to call the number listed in the SMS if this wasn’t you.

- This number is for a fake call centre that may request remote access to your computer and bank accounts or ask you to provide personal or banking information.

- If you have received this type of text message, please forward it to 0476 220 003 (047 NAB 0003) or take a screenshot, email it to phish@nab.com.au and then delete the text message.

If you have called the number after receiving this type of email or text message, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Threats and extortion scams targeting international students

Callers pretending to be immigration and law enforcement agencies are targeting international students. These are not legitimate. Do not act on the threats.

The call may have some of the below features:

- The caller may claim to be from a government agency requesting payment for a temporary visa and threaten legal action if you don’t pay.

- The caller may state that your identity has been used in a crime such as money laundering or creating fraudulent documents.

- They may demand that you transfer money to international authorities for verification.

- They may threaten you with extradition or deportation, cancellation of visas, or criminal charges.

- You may get an email with a link or a call with threatening language requesting immediate payment.

- They may make threats to your life and request you transfer all your funds for verification immediately.

- Never send money or provide personal or banking information to the caller.

- Do not respond to any email containing these threats as this can lead to further intimidation and malicious activities.

- Talk to your friends or family if you’re ever unsure about a call or email and something seems suspicious. This allows you to get a second opinion and can help spread awareness about a potential scam.

- If you have any concerns about your safety, contact police on 131 444 immediately.

If you believe your personal or bank information is compromised, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Invoice scams targeting Australian businesses – November 2023

- An invoice scam is when a business receives an emailed invoice from a supplier whose email account has been compromised by a criminal.

- The criminal will alter the payment details on the invoice to a fraudulent or mule account.

- As the invoice looks legitimate, the business doesn’t question the payment details, and sends the payment to the fraudulent account.

- Another variation of an invoice scam is when a business receives a request advising a supplier’s or employee’s payment details have changed, and to make payments to a new account.

Before processing invoices, check the payment details against the last invoice. If they have changed, or you receive a request to update payment details:

- Do not proceed with the transaction(s), and

- Call the supplier/sender to confirm the legitimacy of the request, using a known contact or publicly listed number. Do not call the number on the new invoice/email.

- Speak to your banker about adding extra security to your account by using a security token, dual authorisation and segregation of duties.

If you have received an email of this type and actioned the request, please contact NAB on 13 22 65 and ask for the Anti-Scam Investigations Team. While we’ll make every effort to recall funds, recovery is not guaranteed.

Learn more about protecting your business from invoice scams .

Fake NAB website directing to remote access software – November 2023

Cyber criminals are creating fake NAB and NAB Connect websites. Do not click anything on this page and close the window immediately.

- A fake NAB and NAB Connect page will ask customers to open a "live chat".

- These links will download a remote access software for criminals to take control of customer devices.

- Do not click anything on this page and close the window immediately.

- NAB will never ask customers to download programs directly from our site.

- NAB will always direct you to the appropriate download source.

If you believe your bank information is compromised, contact us on 13 22 65 or visit your nearest NAB branch immediately.

Fake Ticketing Scams – October 2023

Australians are being targeted by criminals selling fake or duplicate tickets to popular events such as concerts, music festivals and sporting matches. Unfortunately, the tickets either don’t exist or are fake.

- Criminals offer tickets to often sold-out events at heavily discounted prices. Buyers may not know their tickets are fake until they arrive at the event and are refused admission.

- Criminals can create fake ticketing websites that look legitimate and hook buyers in through email scams or pretend to offer tickets through lotteries and competitions that require payment or personal information to secure the tickets.

- Fake ticket scams are also popular on social media and online marketplaces.

- Buyers may be instructed to pay using unusual payment methods, such as cryptocurrency or direct money transfers.

- Ticket reselling websites exploit events in high demand, reselling tickets at excessively high prices.

- It’s recommended that you only buy tickets from authorised ticket sellers. You can check the websites or social media pages of the event promoter, venue, performer or sporting club to find out how to buy official tickets.

- Find out when the tickets are going on sale. Tickets available before the official date may be fake.

- If you search for tickets online, be cautious about clicking on ads that appear at the top of search results, as criminals sometimes pay for these ads to appear at the top, so you might think you’re visiting a legitimate ticket website.

- It’s safer to pay for tickets using a credit card, as your funds may be recovered if something goes wrong. Be cautious if sending funds to a ticket seller’s bank account – private sales don’t offer buyers any protection if the ticket isn’t real.

- If you’re directed to an unexpected website during the payment process, don’t proceed with the purchase.

- Buying tickets through social media or online marketplaces always comes with a risk. If you decide to proceed with the purchase, do so with caution, checking whether the seller has a legitimate profile, positive ratings, or other listings.

- People are quick to call out a scam, so always check reviews for the seller or website before making a purchase.

- Remember, if it is too good to be true, it probably is.

If you believe that you’ve paid money to a criminal in a ticketing scam, contact us on 13 22 65 or visit your nearest NAB branch immediately.

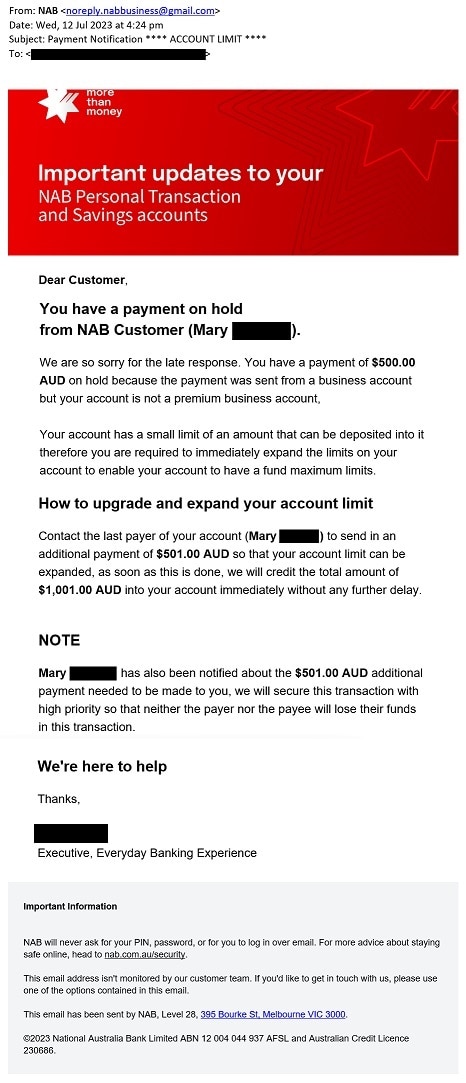

PayID scams on second-hand selling websites – August 2023

We’re aware of NAB-branded emails sent by criminals which states that your payment is on hold, and you need to upgrade to a business account. You may be asked to transfer funds back to the buyer to secure the transaction. Do not send funds. This is a scam.

- Criminals may contact people listing items on online marketplaces.

- Using what’s often a fake or compromised social media profile, they make an offer to purchase the item.

- They’ll ask for the seller’s email to confirm the transaction.

- Shortly after, the criminal claims they have sent the money for the goods using a “NAB” account, and the seller should check their email.

- The seller receives a fake email from “NAB”, claiming the funds are on “hold” because the seller does not have a “business account”.

- The criminal may then claim that they have sent extra money to upgrade the seller’s account, which they may pressure the seller to immediately reimburse. However, no money will appear in the seller’s account.

- If you have received this type of email, please forward it to phish@nab.com.au and then delete the email.

If you have transferred funds after receiving this type of email, contact us on 13 22 65 or visit your nearest NAB branch immediately.

View previous scam alerts

Learn about previous scams and fraud that have impacted customers.

Tips to stay safe online

NAB’s online security, fraud and scams support hub

Explore online security tips, check scam alerts and get fraud support in one convenient location.

Personal security hub

Free resources to help you and your family stay safe online and in real life.

Business security hub

Keep your business and customer information safe with security tips to help prevent fraud.

Other security resources

First line of defence for cyber threats

Learn how you can help keep your business safe with the Cisco Umbrella cyber security solution.

Protect your computer with anti-virus software

Here are some anti-virus software offers for NAB customers.

Australian Cyber Security Centre , opens in new window

Visit this government website for ways to protect yourself from cyber threats.

Still need help?

Call us from the NAB app

Call us securely from the NAB app to skip the identification process and get connected with who you need.

- Log into the NAB app.

- Tap the Search icon.

- Search for ‘call’.

- Tap Contact us.

Personal bank customers

Within Australia: 13 22 65

From overseas: +61 3 8641 9083

To get you to the right team faster, please follow these steps:

- Press ‘3’ on the main menu.

- Select the menu option most appropriate for your situation.

Business bank customers

Within Australia: 13 10 12

From overseas: +61 3 8641 9083

To get you to the right team faster, say ‘Fraud’ when prompted.

Interpreters available

Do you have limited English or prefer to speak in a language other than English? When you call us, just say “I need an interpreter” and we’ll arrange for someone to help with your enquiry.

If you don’t see your language listed, please ask us for help to find someone who speaks your language to help with your banking.

National Relay Service

If you’re d/Deaf or find it hard to hear or speak to hearing people on the phone, the National Relay Service can help. To contact NAB give our phone number 13 22 65 to the National Relay Service operator when asked.

Important information

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

PayID is a registered trademark of NPP Australia Limited.