Business credit cards | Earn points on business rewards cards - NAB

Select your business credit card feature

NAB business credit cards offer low rates, flexible payments, and reward points. Enjoy extra benefits like unauthorised transaction insurance and even get access to specific events.

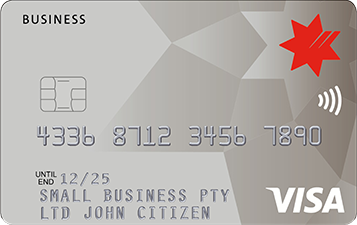

Business rewards credit cards

Earn NAB Rewards Points on travel, technology and more with our flexible business credit card.

Rates and fees

Minimum credit limit

$5,000

Annual card fee

$ 175

per card

Purchase interest rate

18.50 % p.a.

Features

200,000 NAB Rewards Bonus Points

Earn 200,000 NAB Rewards Bonus Points when you spend $8,000 on everyday business purchases within 90 days of your new NAB Rewards Business Signature Card account opening.

NAB may vary or end this offer at any time without notice. See important information below.

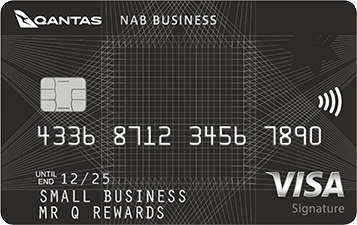

Get more from your business credit card purchases and maximise your Qantas Points.

Rates and fees

Minimum credit limit

$5,000

Annual card fee

$ 295

per card

Purchase interest rate

18.50 % p.a.

Features

150,000 bonus Qantas Points

Earn 150,000 bonus Qantas Points when you spend $10,000 on everyday business purchases within 90 days of opening your new NAB Qantas Business Signature Card account. Plus, unlock additional value for your business with the Qantas Business Rewards loyalty program.

NAB may vary or end this offer at any time without notice. See important information below.

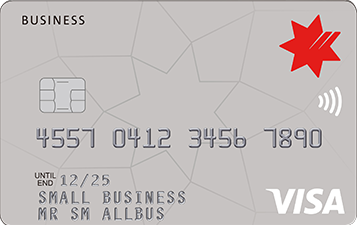

Low rate business credit card

Manage business expenses and cashflow with our lowest interest rate business credit card.

Rates and fees

Minimum credit limit

$5,000

Annual card fee

$ 60

per card

Purchase interest rate

13.25 % p.a.

Features

0% p.a. on purchases for 12 months

Enjoy 0% p.a. on purchases for 12 months on a new NAB Low Rate Business Card.

No annual card fee for the first year.

NAB may vary or end this offer at any time without notice. See important information below.

Corporate and charge cards

Manage your employees' business expenses by giving them their own business charge card.

Rate and fees

Minimum credit limit

$5,000

Monthly card fee

$ 9

per card

Purchase interest rate

15.50 % p.a.

Features

Customised credit card solutions for cashflow, convenience and control over business expenses.

Rates and fees

Cash advance rate

12.65 % p.a.

Features

Plastic-free digital corporate card issued in minutes, providing fast and secure access to funds for business expenses.

Features

NAB business card benefits

Fraud prevention specialists

We take fraud protection and the security of your business card seriously. Learn how NAB Defence and Online Secure protects your accounts.

Unlock rewards and Qantas points

Enjoy our business rewards credit cards and earn Qantas points on everyday business expenses to make the most of your business finances.

Cards to suit your needs

Take control of your business expenses with a credit card that suits your business needs.

Industry leaders

NAB was awarded the Most Recommended Major Business Bank and Most Competitive Major Business Bank at the 2021 DBM Australian Financial Awards.

Changes to your NAB Commercial Card Facility

We’re updating some of the documents which apply to NAB business credit cards and NAB Purchasing and Corporate Card facilities. Find out what’s being updated and when these updates come into effect.

Common questions about business and rewards credit cards

-

You can apply for a NAB business credit card online in just a few steps. Simply provide your business and personal details and we’ll assess your eligibility for a business credit card.

-

A business rewards credit card lets you earn points on everyday business purchases, including ATO payments. They can be redeemed for travel, merch, or other rewards tailored to your business needs.

Help me choose the right credit card for my business

Looking for a credit card to manage your business but unsure which one? Use our selector tool to help you choose the right card for your business.

Looking for a personal credit card?

Explore our range of personal credit cards to help you manage your day-to-day expenses.

Other useful business resources

Business credit card benefits

See the benefits you can get with a NAB business credit card.

Solutions for every small business

Tools, tips and products for every kind of small business.

Help me choose the right business credit card

Our business credit card selector can help you find the right card for your business.

Get in touch

Sales enquiries

Let us help with your business banking needs. Request a call back to chat to a specialist about our range of business and commercial cards.

Contact us

Explore our business banking contact information and get support with a wide range of products, services and topics.

Visit a NAB business banking centre

Let our business banking specialists help you in person.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

NAB business credit cards are for business purposes only.

A valid ABN is required to open a Commercial Card facility with NAB. ABN registration checks will be performed once the application has been received.

Terms, conditions, fees, charges and lending criteria apply.

Approval and credit limit is subject to NAB's credit assessment criteria. Information, including interest rates and annual card fees subject to change. Details are correct as at 31 July 2025 and are subject to change by NAB. Credit cards issued by National Australia Bank Limited.