Change bank accounts | Open a NAB account - NAB

Why choose NAB?

With no monthly account fees and competitive interest rates, switching your banking to NAB is the easy choice. If you’re with another bank, moving everything over isn’t as difficult as everyone makes out.

Here’s how to switch in four easy steps

1. Open an account

Open a savings account or transaction account in branch or online, quickly and easily. You can transfer money into your account straight away.

2. Switch your salary payments

Give your employer your new bank account details to get your salary paid into your new NAB account. If, for some reason, they don’t have a salary payment form, just use ours.

NAB Salary Transfer Form (PDF, 246KB)

3. Switch your payments

Update your employer and government payments (e.g., Centrelink, tax refunds and change billing details for direct debits (insurance, streaming services, utilities)).

4. Notify your old bank

Before closing your old account, make sure you successfully transfer all regular payments to your new NAB account. Keep some funds in your old account Ifor a transition period (1-2 months) to catch any missed payments.

Ready to open a NAB Classic Banking account?

Enjoy easy access to your money with no monthly account fees. Here’s what you’ll need to open your new account online.

Take the hassle out of banking with the NAB app

Card usage controls

More control. More peace of mind

Customise your Visa card settings so you decide when and how you use your card. Switch contactless payments, online transactions, and overseas purchases on and off at the swipe of a finger.

Tap and pay

Overseas travel

Overseas travel notifications

Heading overseas? Let us know where you’re going to help us protect your accounts from fraud. Just switch it on before you head off.

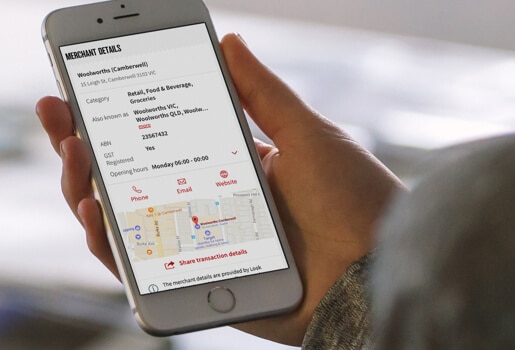

More transaction details

Don't remember that transaction?

Simply select the transaction to get more details about when and where you used your credit card.

Get in touch

Visit a NAB branch

Visit your nearest NAB branch to speak to us in person.

Terms and Conditions

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Consider the NAB Internet Banking terms and conditions which apply when using NAB Internet Banking and the NAB app, before making any decisions regarding these products. The NAB app is compatible with Android™ and iOS, minimum platform requirements apply. Android is a trademark of Google LLC. IOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license. Products issued by NAB.

Target Market Determinations for these products are available at nab.com.au/TMD.